An important notice has been issued in the AAI & MTA car dealer add-on insurance class action.

See the notice and find more information here to register.

Class actions we've pursued

- Action on behalf of people detained on Christmas Island

- Air Cargo class action

- Allco shareholder class action

- Amcor/Visy settlement

- ANZ – Original Class Action (Personal Loans)

- Aristocrat Leisure Ltd class action

- Australian Cotton Project class action

- AVCO class action

- AWB class action

- Bank fees class action

- Bellamy’s class action

- Benlate class action

- Bladder cancer group action associated with Actos™ diabetes drug

- Bonsoy class action

- Black Saturday Bushfire class actions

- Cash Converters Queensland class actions

- Cash Converters NSW class action

- Centaur Mining class action

- Centro class action

- Challenger class action

- CIMIC class action

- Cladding class action investigation

- Colonial MySuper class action

- Commonwealth Financial Planning Ltd class action

- Concept Sports Group class action

- Corporate Travel Management class action

- Crown (China arrests) class action

- DePuy (LCS Duofix Femoral Component) class action

- FAI Home Security class action

- False imprisonment of young people class action

- GIO class action

- Grand Western Lodge class action

- Gunns class action

- Legionnaires' Disease class action

- Leighton class action

- Longford gas plant class action

- Longford Gas Plant Royal Commission

- Maffra Knackery pet food class action

- Media World class action

- Multiplex class action

- NAB class action

- Nomad Telecommunications Ltd class action

- NT Youth Justice class action

- Nufarm class action

- Old England Hotel class action

- OZ Minerals class action

- Pacific First Mortgage Fund claim against Minter Ellison Gold Coast

- Pacific First Mortgage Fund claim against: Philip Sullivan, Thomas Swan, Stephen McCormick & the Estate of the late Ian Donaldson

- Qantas staff credit union group action

- QBE class action

- Radio Rentals class action

- Retail Food Group potential class action

- RiverCity class action

- RMBL class action

- Rubber chemicals class action

- Sirtex class action

- Star shareholder class action

- Tate class action

- Tamaya Resources class action

- Thanh Phu salmonella poisoning class action

- Tobacco Licence Fee Recovery Litigation

- TrackNet class action

- Travacalm class action

- Unlawful detention of people seeking asylum class action

- Vitamins class action

- Vocation class action

- Volkswagen, Audi and Skoda diesel emissions class actions

- Woolworths class action

- Westpac loans class action

- Workers with intellectual disabilities class action

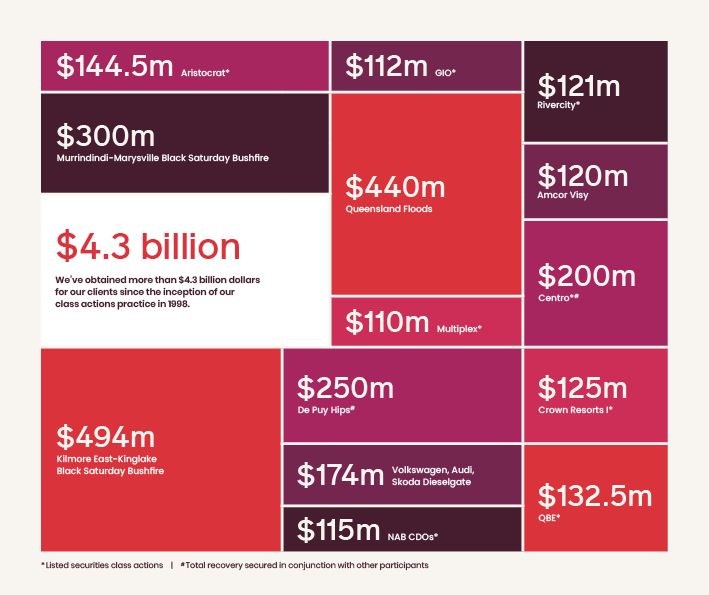

Our class action record is second to none

$4.2 billion

We've obtained more than $4.2 billion in settlements for our clients since the inception of our class actions practice in 1998.

$100m+

We're the only Australian class actions firm to deliver $100m+ settlements to our clients in shareholder and listed securities actions.

Find out more about our class actions work

Join a class action

Learn more about our current class actions and how you can get involved.

Settlement payments

The settlement for these current class actions has been approved and they're ready for payment. Find out more about the distribution process.

Australian leaders in class actions.

Our reputation for excellence in class actions is unparalleled, having recovered more than $4.2 billion for clients.

We are the only Australian class actions firm to deliver $100m+ settlements to clients in shareholder and listed securities actions, which we have done on ten occasions.

Lower cost to clients

Biggest recoveries

Most experienced

We're here to help when you need us most.

Call us on 1800 991 692, or leave us a message below to request a call back and one of our team will be in touch as soon as we can.

Office locations

We’re here to help. Get in touch with your local office.

Select your state below

- VIC

- QLD

- NSW

- ACT

- WA

- SA

- TAS

- NT

Our Canberra office is now closed, but our team continues to serve ACT clients and are available for phone and video appointments. If you need legal advice, please call us on 1800 675 346.

We have lawyers who specialise in a range of legal claims who travel to Tasmania. If you need a lawyer in Hobart, Launceston or elsewhere in Tasmania, please call us on 1800 675 346.

/Client_Testimonial_60x60px_qld.png)